Dividends

Dividend policy

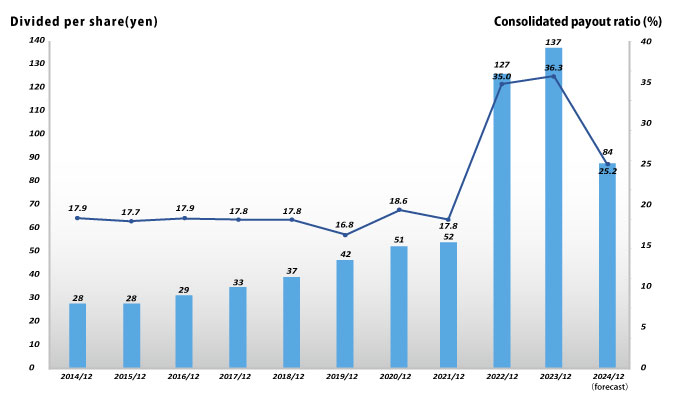

The FUJI SOFT Group will pay dividends based on the basic policy for "consistent redistribution of profits" maintaining a certain level of internal reserves to enable proactive business development and to accommodate unforeseen business risks.

Dividends

| Fiscal year | Dividend (yen) | Non-consolidated payout ratio (%) | Consolidated payout ratio (%) |

| 45th (ended December 2014) | 28 | 22.9 | 17.9 |

| 46th (ended December 2015) | 28 | 19.7 | 17.7 |

| 47th (ended December 2016) | 29 | 18.8 | 17.9 |

| 48th (ended December 2017) | 33 | 19.8 | 17.8 |

| 49th (ended December 2018) | 37 | 19.0 | 17.8 |

| 50th (ended December 2019) | 42 | 18.7 | 16.8 |

| 51th (ended March 2020) | 51* | 23.0 | 18.6 |

| 52th (ended December 2021) | 52 | 17.3 | 17.8 |

| 53th (ended December 2022) | 127 | 40.6 | 35.0 |

| 54st (ended December 2023) | 137 | 39.8 | 36.3 |

| 55th(ended December 2024)(forecast) | 84 | 29.3 | 25.2 |

*Includes a commemorative dividend of 5 yen.

*On July 1, 2023, the Company conducted a two-for-one split of its common stock.

From FY2014 to FY2023, dividend per share are the figures before the stock split.

The FY2024 Plan figures are after the stock split.